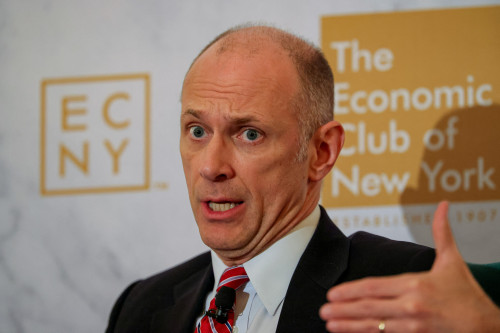

Fed’s Goolsbee: if tariffs are avoided, policy rate can come down

(Reuters) -Chicago Federal Reserve Bank President Austan Goolsbee on Thursday said he believes that if big tariffs could be avoided, either through trade deals or otherwise, the U.S. central bank could likely cut interest rates given the underlying strength of the economy and the direction of inflation.

Comparing the economic effect of tariffs to a layer of fat atop an otherwise healthy set of abdominal muscles, “you’ve got to get all of what’s on top of there off before you can see it,” Goolsbee said at the 2025 Mackinac Policy Conference. “And I feel a little bit like that on the economy. You know, if we could just get this off of there, there’s a sixpack underneath.”

Goolsbee did not comment directly on a ruling Wednesday by a U.S. trade court that blocked many of the tariffs put on by the Trump administration that have threatened to push up inflation and slow economic growth, including the “Liberation Day” levies from April 2.

Before that date, Goolsbee said, the labor market was stable and inflation was heading towards the Fed’s 2% goal, conditions that would allow the Fed to bring the policy rate down from its current 4.25%-4.5% range and toward its long-term settling point. Based on the most recent Fed policymaker projection, that long-term neutral rate is around 3%.

For now, though, uncertainty over tariffs is causing businesses to have a “pencils down” moment as they wait for clarity on trade policy, Goolsbee said.

The Fed finds itself in a similar situation, with policymakers particularly worried about the possibility of tariffs disrupting downward progress on inflation and pushing up the unemployment rate.

(Reporting by Ann Saphir, Editing by Franklin Paul and Andrea Ricci)